When you apply for car insurance you are asked a number of questions about a variety of things such as your name, address, occupation, age, how long you have had your driving license for, the make and model of car to be insured, how many miles you estimate that you will drive the car each year, what the vehicle will be used for and where you intend to park the car overnight. The responses that you provide to the questions enable the insurer to assess the likelihood of you making a claim on the policy and have an effect on the level of premium that you will be asked to pay. The insurer expects that you answer the questions honestly.

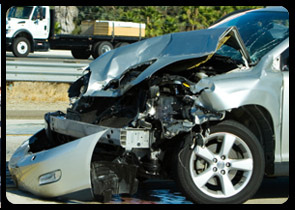

If you have knowingly provided incorrect information when applying for car insurance the insurer may not pay out should you be involved in a road traffic accident and claim on your policy.

Well, some interesting research has recently been carried out on behalf of Kwik Fit Insurance Services entitled “Attitudes to driver honesty and safety”. There were 2,039 GB people at least 18 years of age that took part in the survey and it provided some interesting findings.

Of those taking part in the survey, 9% held a provisional driving license and 76% held a full driving license. The survey revealed that 18% of those people with a full driving license actually admitted that, in order to obtain motor insurance more cheaply, they had altered certain facts when applying for cover. 92% of those people with that type of license realised that providing false information to an insurer was a fraudulent act.

Of those people with a full driving license taking part in the survey, 8% admitted to tweaking the answer that they gave about where they kept their car overnight, 8% admitted to tweaking the answer they gave about the annual mileage they do, 6% tweaked the answer about their job title, 5% said that they only use their car for social purposes when they also use it for commuting to work, 3% underestimated the car’s value and 1% tweaked the answer they gave about modifications to their cars.

We are sure that you will agree the above findings are rather concerning. If a motorist who had fraudulently provided inaccurate information when applying for car insurance were to make a claim on their policy then the insurer could refuse to pay out. That policyholder may find it more expensive to obtain such insurance in the future with possibly fewer insurers being prepared to consider providing such cover.